GOODS & SERVICES TAX

GST Training in Chandigarh

GST Training is available in Chandigarh at the IPAT Institute. Learning

about the goods and services tax in India under the guidance of the best

teachers with the help of their students gives a great opportunity to

gain a comprehensive understanding of the Indian GST system and its

application. Register on the GST Portal and pass an exam to obtain a

certificate before he can start his practice or business. This will help

you calculate the management of your capital.

GST Training in Chandigarh at IPAT Institute. This subject covers the fundamental concepts, principles, and legal provisions related to Goods and Services Tax (GST) in India. Students will learn about GST registration, compliance, filing returns, and managing GST accounts for businesses.

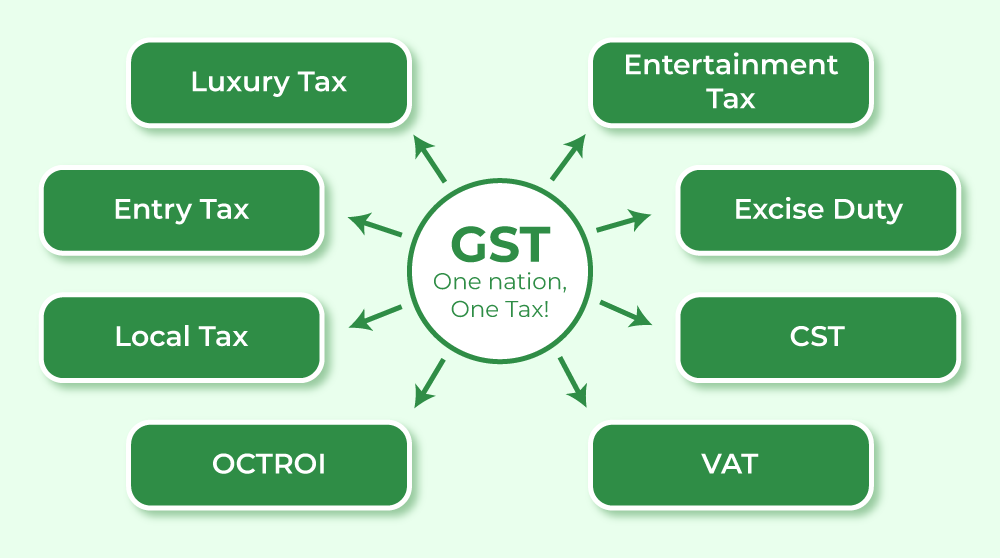

Overview of GST: It is a destination-based, multi-stage, comprehensive tax levied at each stage of value addition. Having replaced multiple indirect taxes in the country, it has successfully helped the Indian Government achieve its ‘One Nation One Tax’ agenda.

The tax is levied on goods and services sold within India’s domestic boundary for consumption. Implemented by a majority of nations worldwide with respective customizations, the tax has been successful in simplifying the indirect taxation structure of India.

GST is levied on the final market price of goods and services manufactured internally, thereby reflecting the maximum retail price. Customers are required to pay this tax on a purchase of goods or services as an inclusion in their final price. Collected by the seller, it is then required to be paid to the government, thus implying the indirect incidence.

Types of GST: The types of GST are State Goods and Services Tax (SGST), Integrated Goods and Services Tax (IGST), Central Goods and Services Tax (CGST), and Union Territory Goods and Services Tax (UTGST).

Registration under GST: For businesses that operate in most states, the GST limit for registration is an annual turnover of Rs. 20 lakhs (for the supply of services) and Rs. 40 lakhs (for the supply of goods). GSTR filing, and registration are among the procedures that can be done online. This has greatly streamlined the procedure and allowed startups to easily register for GST services in one location.

Rates under GST: The GST rates on different goods and services are uniformly applied across the country. Goods and services have, however, been categorized under different slab rates for tax payment. While luxury and comfort goods are categorized under higher slabs, necessities have been included in lower and nil slab rates. The main aim of this classification is to ensure the uniform distribution of wealth among residents of India.

E-Way Bill: There is also provision of E-Way bill. E-Way Bill is an Electronic Way bill for movement of goods to be generated on the E-Way Bill Portal. A GST registered person cannot transport goods in a vehicle whose value exceeds Rs. 50,000 (Single Invoice/bill/delivery challan) without an e-way bill that is generated on ewaybillgst.gov.in. Alternatively, E-Way bill can also be generated or cancelled through SMS, Android App and by site-to-site integration through API entering the correct GSTIN of parties. Validate the GSTIN with the help of the GST search tool before using it. When an E-way bill is generated, a unique E-Way Bill Number (EBN) is allocated and is available to the supplier, recipient, and the transporter.

E- Invoicing: ‘E-Invoicing’ or ‘Electronic Invoicing’ is a system in which B2B invoices and a few other documents are authenticated electronically by GSTN for further use on the common GST portal. The taxpayers must comply with e-invoicing in FY 2022-23 and onwards if their e invoice limit or turnover exceeds the specified limit in any financial year from 2017-18 to 2021-22. Also, the aggregate turnover will include the turnover of all GSTINs under a single PAN across India.

GST Course Training in Chandigarh

COURSE OVERVIEW:

- Basic Concepts

- GST Registration Process

- Return Filing

- Reconciliations

- Exposure to GST Software.

- Other Compliances

Career Support: Get guidance on Goods & Service Tax and explore career paths.

Certification: Earn a prestigious GST certificate.

Duration: ( 2 Months )